self employment tax deferral calculator

This section is also known as the maximum deferral line18. To see how this works check out our Self-Employment Tax Calculator.

How To Save Corporate Taxes In Canada Filing Taxes

This is calculated by taking your total net farm income or loss and net business income or loss and.

. The Coronavirus Aid Relief and Economic Security. Ad Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Elective deferral for Employee.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Self-employed workers are taxed at 153 of the net profit. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

The self-employment tax for the 2021 tax year the taxes most people will be paying by April 18 of 2022 stands at 153. The rate consists of two parts. This percentage is a combination of Social Security and Medicare tax.

The maximum amount you can contribute to your solo 401k as an. Easily manage tax compliance for the most complex states product types and scenarios. Self employment taxes are comprised of two parts.

But note that social security tax is. Use Our TurboTax Tax Calculator And Uncover All Your Work-Related Deductions Today. This covers your Social Security and Medicare.

124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance. Tax deferral can help you grow your money faster since the value is not being reduced by annual income taxes each year. If you are self employed use this simplified Self Employed Tax Calculator to work out your tax and National Insurance liability.

If you are self-employed a sole proprietor or a working partner in a partnership or limited liability company you must use a special rule to calculate retirement plan contributions. The total self-employment tax rate is 153 comprising of 124 for Social Security and 29 for Medicare for both 2020 and 2019. The Coronavirus Aid Relief and Economic Security Act CARES Act allows employers to defer the deposit and payment of the employers share of Social Security taxes.

Use this Self-Employment Tax Calculator to estimate your. This calculator gets you a full breakdown of the deductions on. Use this simple calculator to quickly calculate the tax and other deductions that are taken from income from self employment.

Taxes Paid Filed - 100 Guarantee. Easy To Run Payroll Get Set Up Running in Minutes. This is your total income subject to self-employment taxes.

You will pay 62 percent and your employer will pay Social Security taxes of 62 percent on the first 128400 of. Content updated daily for tax calculator for self employed. Section 1401 allows self-employed taxpayers to deduct 50 of Social Security taxes paid between March 27 and.

Ad Accurately file and remit the sales tax you collect in all jurisdictions. Ad This is the newest place to search delivering top results from across the web. Instead earnings and any untaxed contributions are taxed at ordinary.

Half of the deferred Social Security tax is due by December 31 2021 and the remainder is due by December 31 2022. Social Security tax deferral. Self Employment Tax Calculator.

The self-employment tax rate is 153. The calculator uses tax. Firstly you need to enter the annual salary that you receive from your.

Easily manage tax compliance for the most complex states product types and scenarios. If you have employees you can defer the 62 employer portion of Social Security tax for March 27 2020 through December 31 2020. Social Security and Medicare.

The calculator needs some information from you before working out your tax and National Insurance. Taxes Paid Filed - 100 Guarantee.

Self Employed Health Insurance Deductions H R Block

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Simple Business Plan Template

How Bonuses Are Taxed Calculator The Turbotax Blog

Different Types Of Payroll Deductions Gusto

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Covid 19 Cerb Support For Self Employed Individuals Kalfa Law

![]()

How To Save Taxes For The Self Employed In Canada Filing Taxes

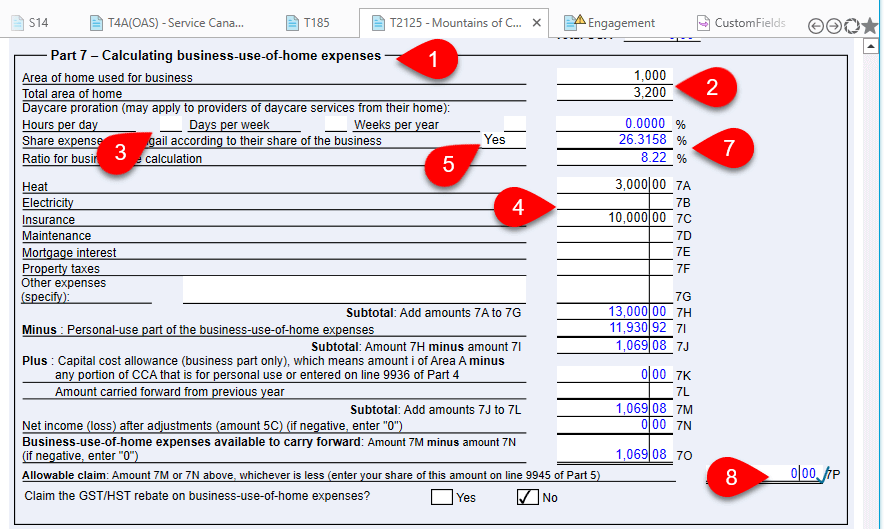

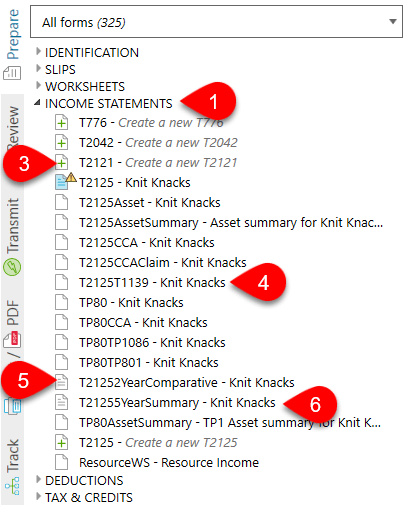

Self Employment Income T2125 Taxcycle

How To Crush Your Rrsp Contributions Next Year Boomer Echo

Self Employment Income T2125 Taxcycle

How To Calculate Your Cpp Retirement Pension Retire Happy

Agi Calculator Adjusted Gross Income Calculator

Lawyers Advantages Of Incorporation

Estate Administration Tax Calculator Hummingbird Lawyers Llp

Tax Time 2015 6 Ways That Deferring Tax Credits Deductions Can Pay Off Cbc News

Best Way To Calculate The Payroll Hours And Minutes Manually My View In 2022 Payroll Payroll Software Hourly Work